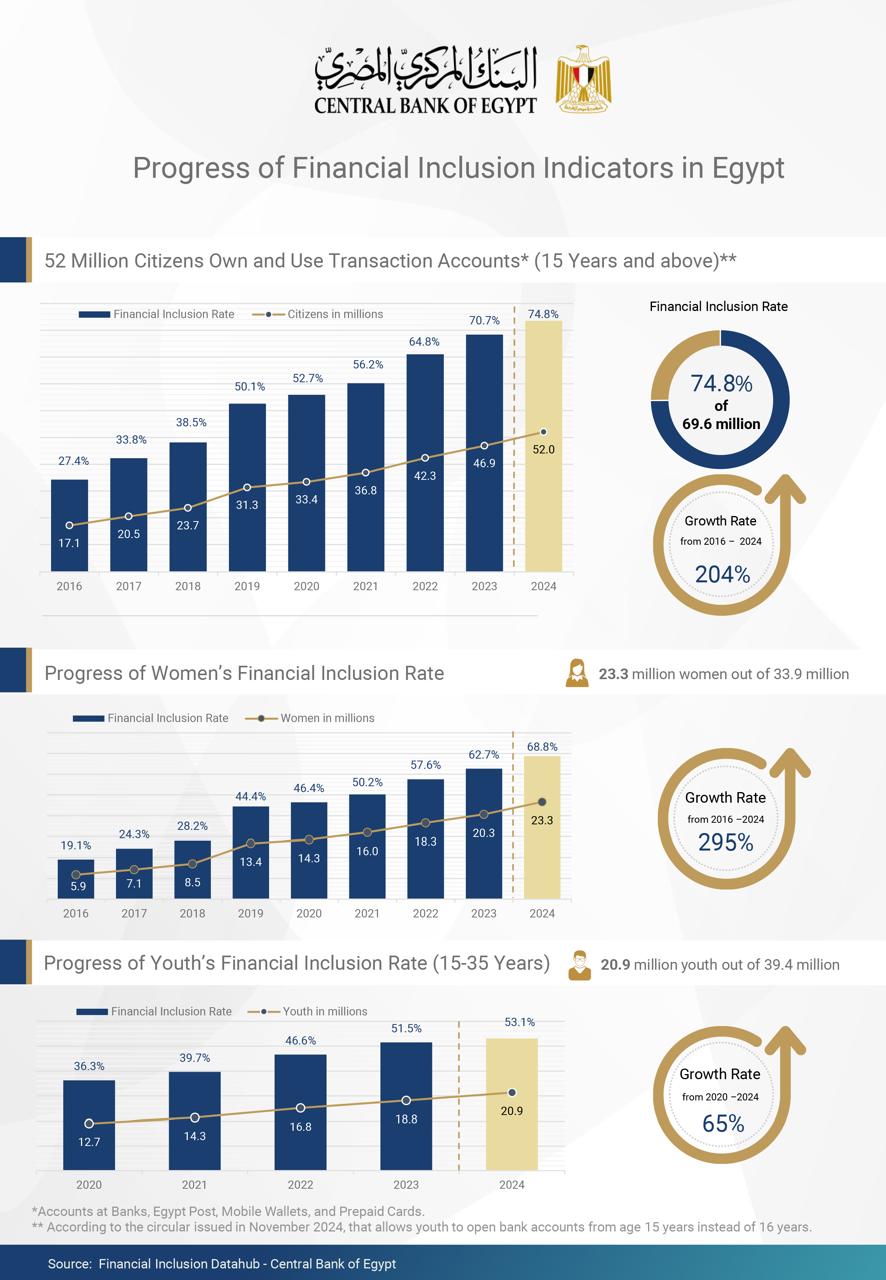

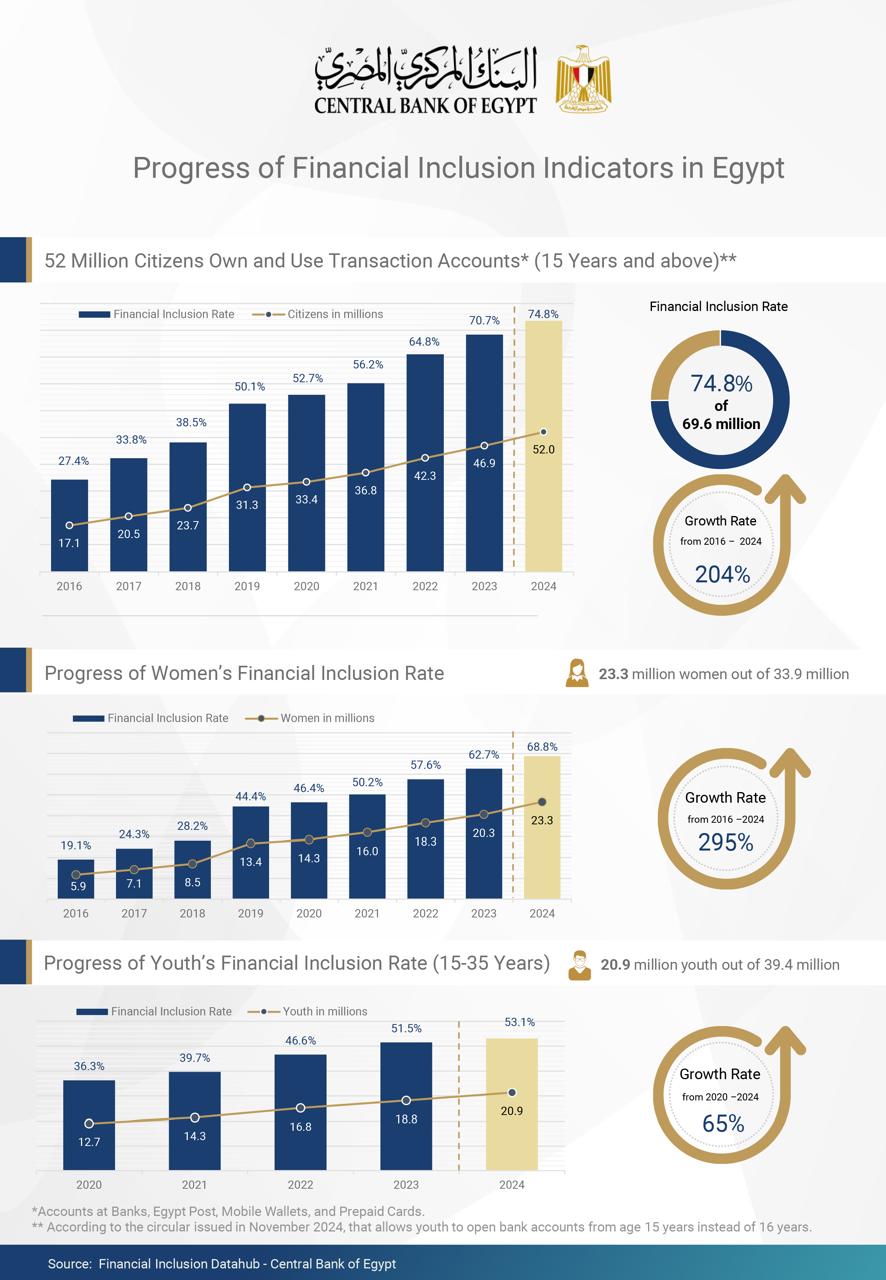

Egypt continues to solidify its position as a regional leader in financial inclusion, with rates climbing to 74.8% by the end of 2024, according to the latest data from the Central Bank of Egypt (CBE).

This growth reflects the increasing adoption of financial services, with 52 million citizens actively using transaction accounts across banks, Egypt Post, mobile wallets, and prepaid cards. These accounts are not just opened but are actively utilized, enabling effective financial management.

The CBE’s strategic initiatives, in collaboration with the banking sector, ministries, and financial authorities, have been instrumental in achieving this milestone. Their efforts primarily target the economic empowerment of women, youth, people with disabilities (PWDs), and entrepreneurs.

Read also:

Mass Developments & Inspire Integrated Partner to Elevate “Olin” in New Cairo

Egypt Kuwait Holding Reports Strong 2024 Results, Expanding Amid Market Challenges

Since 2016, Egypt’s financial inclusion has surged by 204%, despite the expansion of the eligible population base. A key regulatory shift lowering the minimum age for bank account ownership from 16 to 15 has played a crucial role in accelerating this inclusion.

Women and Youth Lead Financial Inclusion Growth

Women’s financial inclusion has experienced remarkable progress, with 23.3 million women now utilizing financial accounts a 295% increase since 2016 bringing their inclusion rate to 68.8%. Similarly, youth financial inclusion (ages 15-35) has climbed to 53.1%, reflecting 65% growth between 2020 and 2024.

Simplified Banking Regulations Expand Access

To further expand access, the CBE introduced simplified account opening procedures, allowing individuals and handicraftsmen to open accounts using only their National ID cards.

This initiative has led to 1 million new financial inclusion accounts and 400,000 “Economic Activity Accounts” between 2022 and 2024, integrating more citizens into the formal financial system.

Financial Inclusion: A Pillar of Egypt’s Vision 2030

The CBE’s financial inclusion indicators play a critical role in monitoring progress and shaping policies that drive economic empowerment and sustainable development.

By providing accessible, cost-effective financial services, financial inclusion is fostering savings culture, streamlining transactions, and reducing financial costs, ultimately enhancing citizens’ quality of life and supporting Egypt’s Vision 2030.

For more real-time economic news, follow us on our Facebook page here:

The Economic Digest website is an online platform specifically designed to provide users with comprehensive summaries of the most important economic events occurring in global and regional markets.